|

Information about Changes and Additions to the Georgian Tax Code... |

|

|

|

|

Wednesday, 11 August 2010 17:48 |

|

Based on Order No. 3489 of Georgian President the Changes and additions to Georgian Tax Code has been come in force since August 1st except articles No. 35, 36, 37, 38, 40 and paragraph b) of the article No. 41, which will come in force from September 1st.

These changes and additions also maintain the growth of penalties and sanctions and excise tax on Alcoholic beverages. These very changes also will be overlooked in Autumn and final version will come in force from January 1st, 2011.

Read more... |

|

Buildings and constructions on Batumi Oil Refinery Territory are for sale for 14.5 million USD… |

|

|

|

|

Tuesday, 10 August 2010 10:36 |

|

Batumi, Tamari settlement, buildings located on the territory of Batumi Oil Refinery; 01 – shed, 02 – lavatory, 03 – pumping room, 04 – administrative, 05 – transformer’s office, 06 – pumping station, 07 – dining room, 08 – automatic bottling spot , 09 – operational office (disestablished) 10 – administrative operational office, 11 – pumping room, 12 – pumping room, 13 – pumping room, 14 – warehouse/workshop 15 – transformer’s office, 16 – shed, 17 – pumping room, 18 – lavatory, 19 – pumping room (disestablished,) 20 – operational office, 21 – oil reservoirs, oil reservoirs from 1 to 46, 47 – technical water reservoir and the 232 607 sq.m. plot of land attached to it; buildings (overall area – 948.9 sq.m.) and the 1 541 sq.m. plot of land attached to it; buildings №1 - operational office, №2 – transformer’s office, №3 – pumping room, №4 – oil reservoir, №5 – oil reservoir and the 14 943 sq.m. plot of land attached to it; buildings №1 - shed, №2 - operational overpass and the 4 470 sq.m. plot of land attached to it; 987 sq.m. plot of land; №1 – buildings (overall area – 174.80 sq.m.) and the 40 500 sq.m. plot of land attached to it; 3 585 sq.m. plot of land; technical water pipe (length 4 455.46 meters; linearly structured dam (length 409 m.) railroad overpass (length 214.99m;) pipe (length 7 655.19 m;) railroad overpass (length 904.5 m;) pipeline (oil pipes: 1 – diameter 250 mm. length 1259.4 (oil;) 2 – diameter 300 mm. length 2283.2 m (petrol;) 3 – diamater – 300 mm. length – 3 478.4 m(oil)), length 7021 m; railroad overpass (length – 185 m;) railroad overpass (length – 185 m.)

Detailed information...

|

|

Saturday, 31 July 2010 14:44 |

|

On July 31, 2010 meeting was held with chairman of International Consortium of High Technology Mr. Elia Tannoury at International Investors Association office. After meeting with Minister of Finance and Economy, Mr. Elia Tannoury offered his help and support to association members concerning high technology issues. The meeting was held in friendly atmosphere and promises new and interesting projects in future. |

|

Georgian International Investors Association members attended the faculty program devoted to USA requirements for importation of GSP-eligible agricultural products... |

|

|

|

|

Tuesday, 27 July 2010 11:32 |

|

In July 2010, CLDP was held workshops, sector-specific meetings, and site visits in Tbilisi, Kutaisi and Batumi for relevant government officials, trade association representatives, and private sector producers on how to expand Georgia’s exports under the GSP program and how to satisfy U.S. import standards and regulations. In July 2010, CLDP was held workshops, sector-specific meetings, and site visits in Tbilisi, Kutaisi and Batumi for relevant government officials, trade association representatives, and private sector producers on how to expand Georgia’s exports under the GSP program and how to satisfy U.S. import standards and regulations.

The faculty for the program was held on July 26, 2010 by representatives from the Office of the United States Trade Representative (USTR), the U.S. Food and Drug Administration (FDA), the U.S. Department of Agriculture (USDA), the Alcohol and Tobacco Tax and Trade Bureau (TTB), U.S. Customs and Border Protection (CBP), and the U.S. Department of Commerce.

The faculty program objectives were as:

1. To provide practical assistance to Georgian agribusinesses and the Government of Georgia on how to recognize and take advantage of market opportunities in order to increase exports to the United States.

2. To improve the skill and knowledge level of the Government of Georgia and the private sector to recognize and follow U.S. government requirements for importation, especially for agricultural products.

3. To improve the ability of the Government of Georgia and private sector exporters to take advantage of the U.S. GSP program.

A Joint Needs Assessment of Georgia by the United Nations and the World Bank noted that exports of Georgian goods and services were expected to decline by 22 percent in the beginning of 2009. In addition, according to the National Statistics Office of Georgia, Georgia’s exports to U.S. in 2009 totaled only $37 million (3% of total exports) and included just 9 of the 3,400 eligible product types under the Generalized System of Preferences (GSP) program. The agribusiness sector, which accounts for 16 percent of Georgia’s economic output, has been the basis for significant exports to other nations.

Increased output and exportation of GSP-eligible agricultural products to the U.S. is possible by providing technical assistance to improve Georgian exporters’ ability to meet U.S. food and beverage import standards and regulations and to expand their use of GSP duty-free export opportunities. |

|

Friday, 23 July 2010 16:20 |

|

Commercial attache of France Mr. Daniel Patat was on a visit to International Investors Association of Georgia. Caucasus coordinator of French Businessmen council was engaged in the visit as well. The meeting was introductory. The chairman of Association Mr. Cemal Bilgingulluoglu informed the guest about the association structure, main goals, visions and priorities. Guests became interested in Association’s activities after the meeting with the government of Adjara. They were satisfied with the businessmen’ successful activities in Adjara region and with an advantage investment environment. |

|

Investing Across Borders 2010... |

|

|

|

|

Friday, 16 July 2010 16:32 |

|

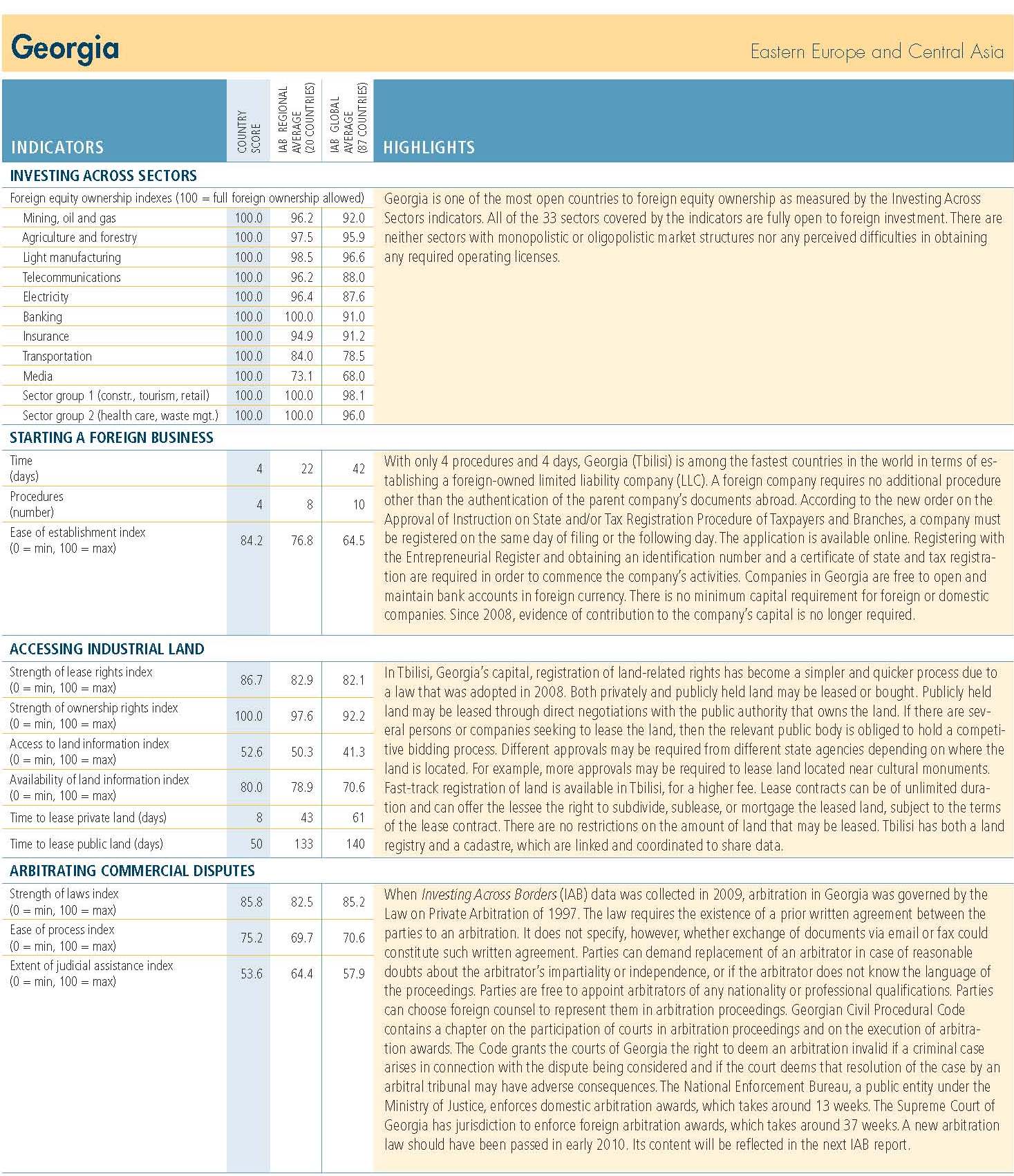

Based on a new report by the World Bank “Investing Across Borders 2010”, Georgia is one of the most opened countries for direct foreign investments among 87 countries in the world. Based on all indicators of mentioned research of World Bank, Georgia is fully opened for foreign capital and there are not any restrictions to foreign companies. Only 4 procedures and 4 days is enough to establish the business and LTDs in Georgia. Foreign company does not need any additional documents or permissions that it represents the subsidiary company of existed company in foreign country. Company is able to sign in the necessary documents for registration in “online” regime and receive the identification number. The companies are able to establish bank accounts in foreign currency. There is no any demand of existence of minimal foreign capital for local companies as well as for foreign companies. The establishment of business in Georgia can be done in less than a week. Based on mentioned research, it is necessary 33 days to establish the business in Poland, in Russia-31 days, in Greece-22 days, in Bulgaira-20 days, Armenia-18 days, Turkey 8 days. More than 6 months is necessary to begin the business in Angola (263 days) and Haiti (212 days). According to the law adopted in 2008, the registration issues concerning the possession of land has been significantly simplified and accelerated. Only 1 week is necessary to hold land under lease in Georgia while the mentioned procedure needs 5 months in Poland. The land of government’s property is possible to lease in 50 days while in Bulgaria it continues almost 1 year (352 days). Investing Across Borders 2010aims to help countries develop more competitive business environments by identifying good practices in investment policy design and implementation. It provides indicators examining sector-specific restrictions on foreign equity ownership, the process of starting a foreign business, access to industrial land, and commercial arbitration regimes in 87 countries.

See statistic...

|

|